Click for currency

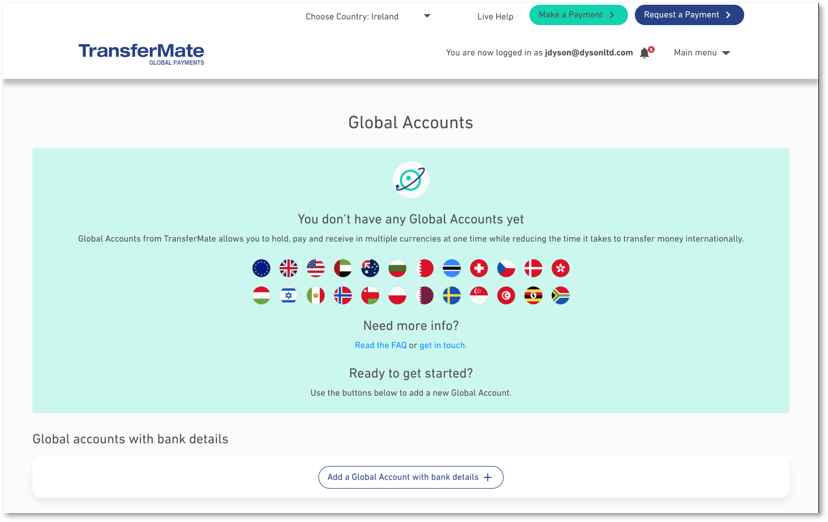

In late 2021, TransferMate launched ‘Global Accounts’, a way for businesses to build their own international network of bank accounts in multiple currencies and within multiple territories. As a multi-currency treasury solution, it allows businesses to have greater control over their international cash flow, make significant savings on FX and banking fees, and easily move into new territories and begin trading there.

As we approach a year in the life of Global Accounts, we talk to the person behind the development of the product, Jonathan Church, and discuss how TransferMate clients have been using the it across a variety of sectors.

If you want to jump to your particular sector or use case, you’ll find a menu below, but the conversation with Jonathan began with the basics – what is Global Accounts and how does it work.

Q. So, let’s start at the beginning. What is Global Accounts and what does it do?

Global Accounts is a solution that sits on a single platform and allows the user to open local accounts in multiple currencies in real-time.

It gives you unique bank details in a large number of currencies and therefore helps you get paid in local currency and/or by local payment schemes, allows you to hold funds in different currencies, convert between those different currencies and payout across the entire T network in a broad range of currencies.

Q. How much money is flowing through Global Accounts right now?

We’re processing multimillions of transaction flow every single month. The product’s been growing rapidly with well over 100 clients onboard already, and what’s really pleasing is we’re seeing a massive variety of different customers and industry sectors using the solution.

Q. And what’s the big takeaway for you from watching Global Accounts operate for a year?

One of the major things has just been the flexibility and the applicability to so many different businesses. Any business that has got multi-currency flows and international business can get value from the solution.

We’ve got everything from small charities receiving overseas donations through to large payroll businesses, a lot of international services and manufacturing businesses, commodity trading businesses… a real variety of customers are getting value out of the solution.

Q. And what’s the biggest feedback you get from clients that have been using it?

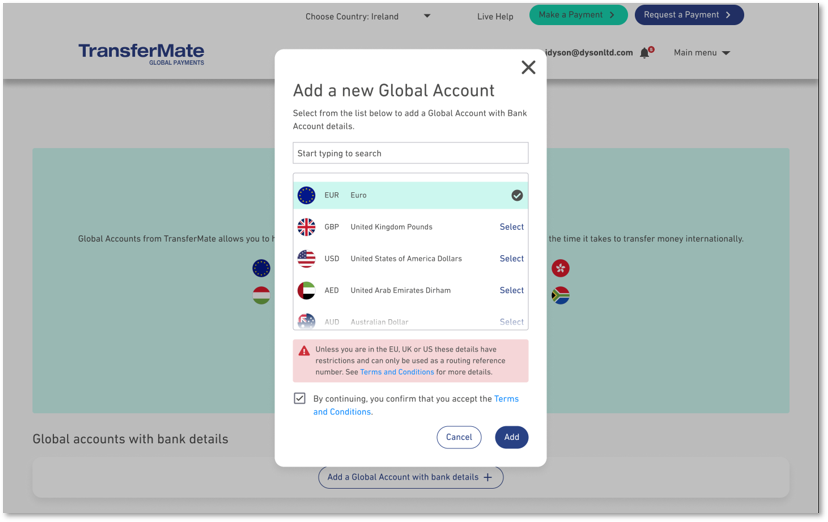

One of the best bits of feedback has been about how straightforward the solution is and how quick it is to get up and running on the solution.

In the click of a few buttons or through a single API request, a customer can open a brand-new account

In the click of a few buttons or through a single API request, a customer can open a brand-new account with unique account details that they can use in their name, in whatever currency they need. That’s rapid versus traditional bank account opening with traditional banks.

Q. I want to talk about use cases now, but before we go into specific industries, what type of organization should be looking at a product like Global Accounts? What pain points does it solve and who benefits?

It really is as simple and fundamental as any business dealing in multiple currencies.

If you’re getting paid in a different currency to the one that you operate with, report in and/ or borrow in your home market, or where you are paying suppliers or have payables in a different currency, or a combination of the two, Global Accounts will bring you value.

There are many common ways businesses are using Global Accounts, but we wanted to dive into specific sectors to see if we’re finding unique ways it’s being used.

Q. Let’s go into some specific ones now, and let’s talk about banks and financial institutions first. How are they using Global Accounts?

One of the earliest use cases was with a major international bank, and it’s also an example where that power of integration comes into play.

We had worked with them previously on building an international receivables solution. It was one of those classic cases where the bank leveraged our infrastructure so their clients could send payments through our network rather than the more complex correspondent banking network. We often say we’re the ‘Intel chip’ inside these payment chains – silently powering the payment process on behalf of our clients.

Transfers were quicker, more transparent, and more cost-effective for the bank and opened up additional FX revenue for them.

Global Accounts was integrated into this solution and used as a unique account mechanism to receive funds in local currency before they get converted back to the home currency of the client. These funds would then be repatriated back to their main bank account.

The upshot was that those transfers were quicker, more transparent, and more cost-effective for the bank and opened up additional FX revenue for them.

Q. Let’s talk about a sector like manufacturing. Where does the benefits come in here?

Manufacturing is the classic use case – it’s probably the one where the benefits are immediately obvious for anyone working in a manufacturing business.

So, several of our clients operate on a global level. They trade in multiple countries, in multiple currencies, and how they manage their supply chain is a core part to any success they’ll have. They need to be agile in terms of where they source materials and manage their international cash flow efficiently so they can have money in the right place and at the right time.

Of course, where you source supplies from is almost certainly different to where your customers are buying from, so multiple currencies coming in and out of your accounts is a fact of life.

With Global Accounts, having accounts that you can align to each of those currencies to be able to both receive into and pay out allows you to manage it all centrally through one single platform, add currencies whenever you like, and manage your overall positions between those currencies.

Q. Let’s move on to retail now. What types of retailers have been using it and how have they been using it?

A good example in the retail space is a well-known sports branding company for a particular market in North America. They use the accounts to fund their payroll expenses in a local market.

They get paid in a whole host of different currencies, so they use our account infrastructure to be able to bill and collect in local currency from their clients.

They’re able to support the business and fund through their Global Account in primary currency from where they’re based, but then use our account infrastructure and our broader network to pay out in other currencies to support their business and their rep offices and their retail stores in another market.

Another example is international car sales and leasing. One operator we work with offers car sales and leasing across the whole of Europe. Because of this footprint, they get paid in a whole host of different currencies, so they use our account infrastructure to be able to bill and collect in local currency from their clients. They can then periodically convert funds back to their main currency and back to their main bank account where required.

Q. Let’s talk about payroll. How does global accounts help with international payroll in particular?

Payroll is another perfect demonstration of where you can get real value from Global Accounts. It’s one where you have single funding in a single main currency, but it’s going out to many beneficiaries in many currencies in many places.

So, Global Accounts provides a mechanism to fund in a currency quickly, easily, and just in time, and then utilises the entire TransferMate network to make a variety of payments in different currencies.

We have some payroll companies who are even able to invoice for the businesses that they’re doing payroll on behalf of and allow them to pay directly into the global account with TransferMate to fund the payroll they’re doing on their behalf.

Q. Procurement. The big procurement platforms and individual businesses that do their own procurement (or use those platforms themselves), where does global accounts benefit them?

Yes, we work with world-leading procurement platforms and they’re a prime beneficiary of the Global Accounts solution.

Apart from all the benefits we’ve already outlined – that leveraging of our more efficient global payment rails – just being able to give individual merchants or individual customers a dedicated account to pay into and receive into allows segregation of business flows, segregation of currencies, and helps reconciliation all those payments in relation to procurement activities or disbursements.

Q. How about charities and nonprofit organizations?

This is another use case that’s actually been more prevalent than we’d imagined. Charities obviously tend to rely on lots of overseas donations, so money is coming into them from multiple currencies, and then they disperse that money out to lots of different locations too depending on need.

They also don’t have to convert currencies multiple times when they have to shift resources around, which is a real cost-saving too.

For them, being able to have local accounts where their donors are allows them to receive money quickly and cost-effectively, and the same goes for when they are paying out. They also don’t have to convert currencies multiple times when they have to shift resources around, which is a real cost-saving too.

Q. I want to ask about e-commerce and online marketplaces, explain how it works there and who benefits.

In the e-commerce and marketplace space, there’s two use cases around Global Accounts.

One is allowing payment into the account as an alternative to a card rail. This will save the merchant money, and that you won’t have the interchange fees on a card. So, it allows them to receive funds in local currency and cheaper than those traditional rails.

The second use case is where online retailers and marketplaces are also acquiring transactions via card. The Global Account can be used to receive those merchant disbursements from the card schemes. This is versus the traditional way where those would be paid normally in a small subset of currencies prescriptively defined to the merchant. And then they will be on the other end of large FX spreads when receiving them into their bank account from somewhere else in a different currency.

So, they can receive in the local currency and then decide how they want to use those funds i.e. when they want to convert them and leverage the competitive rates that TransferMate’s able to offer.

Q. When it comes to trade and receivables finance. Do you just want to talk through a little bit there?

This is a use case and a sector where we’ve got some very interesting ongoing conversations. The goal is to leverage Global Accounts for working capital financing. We’re looking at receivables financing solutions, where the funders and the financiers of the solutions can pay in quickly and easily in local currency into a global account in one currency, and funds can be seamlessly converted into the currency and paid away to the business that is selling its invoices, for example, on the other side.

So it allows both the seller of the invoice and the financier/purchaser of the invoice to both have Global Accounts and leverage those to make the movement of funds between them in cross currency happen faster and easier than it would through multiple traditional banking accounts and networks.

Jonathan. Thanks very much.

To learn more how Global Accounts can benefit your organization, contact the team.

A hundred years ago, the largest private company in the world in terms of number of employees was Siemens with a respectable 87,000 people. Today, that number would barely be enough to breach the top 200.

The lesson here is that businesses have become increasingly larger and, more importantly, more global. Having offices dotted around the world is a source of pride, and our supply chains are now so globalized that even small businesses leave a footprint around the world. It means that a large percentage of businesses are dealing across borders, utilizing multiple currencies and leveraging the global banking infrastructure to get business done.

With this comes the challenge of international cash management – how do you efficiently manage all your globalized bank accounts and currencies to optimize both cash flow and, ultimately, revenue?

We sat down with Jonathan Church, Global Accounts Product Management at TransferMate Global Payments and financial expert, to explore how businesses can make international cash management a competitive advantage, not a daunting challenge.

Q. Hi Jonathan. Let’s start at the fundamentals – how would you define international cash management?

International cash management is all about getting money in the right place, at the right time, and in the right currency. Everything else flows from this basic principle.

Q. And then what are the traditional ways of going about it? What have large enterprises been doing over the last couple of years or decades?

Traditionally, and especially if you’re a big organization, you would probably have lots of accounts with lots of different banks in lots of different places and likely in lots of different currencies.

So, you’d have resources dotted around all over the place to support lots of local transactional needs, and then you would need to link that up with a large global bank to help you join up those dots and optimize management across that infrastructure as much as possible. It requires a lot of legwork on behalf of the business. If, for example, you wanted to start doing work – in any new country – your accounts department would have to choose a bank, go through the KYC (Know Your Customer) process, then you might need to secure a credit line to pay staff and suppliers before the business is able to get meaningful liquidity in the country… and this could all take weeks, if not months.

We’re trying to break that cycle – it’s slow to set-up, complex to manage and not agile enough for companies wishing to do business in new markets, both quickly and at scale.

We’re trying to break that cycle – it’s slow to set-up, complex to manage and not agile enough for companies wishing to do business in new markets.

Q. Obviously it’s all dependent on which country you choose, but what is the rough timeline to get set-up in a new country?

Nowadays with all the regulatory and compliance requirements, you would be very, very lucky to be able to open a bank account in a new country in less than a few weeks. To give an example, all of the banking infrastructure that we have opened to support the global accounts solution took us about five months end-to-end to open with a large transaction bank across multiple territories, regions, and through multiple bank entities.

And that’s coming from us as an organization that works in financial services, is adept at navigating the bureaucracy, and has, we’d like to think, a reasonable amount of clout and persuasion and buying power with banks. So, if it takes us five months to open all of that account infrastructure, it would perhaps be longer for smaller organizations, particularly if they’ve not got the time and resources focused on it.

Q. That must be a real barrier to doing business, particularly for rapidly growing companies…

Yes. Absolutely. It’s also not just about time – you’ll almost certainly end up getting hit with costs in the process too.

Let’s say I was a UK corporate and I suddenly have a new opportunity to start selling to Australia.

It would probably take me weeks to open an Australian dollar bank account with my UK bank, and probably months to open an Australian dollar account in Australia with an Australian bank. In the shorter term then, I’m going to have to make international cross-currency payments through a traditional player, which means I’m going to incur all of the friction, time, cost, and poor FX rates of managing payments that traditional way.

So, basically, if you can’t get set-up quickly in a new country, you’ll end up incurring a lot more time, cost, and resources while getting it done.

Q. I want to focus the subject of risk. Where do the big risks lie in international cash management? What are those big-ticket items? Is it lack of visibility? Is it a currency crash?

Well, firstly, you’ve got the risk and the cost of inefficiency. If you get it wrong and you don’t have funds in the right place at the right time and in the right currency, you’re going to basically borrow that money – and it’s not going to be cheap or planned for you to do it.

So, you will have a liquidity cost of using a working capital facility or a settlement line to make payments. Not dissimilarly, you may have the FX cost. If you haven’t planned it and you have to execute a transaction unexpectedly, you will end paying the prevailing bank FX rates, which will never be the best one. If it’s a big transaction, especially, that ends up being a big hit on the bottom-line.

That’s the inefficiency piece.

There’s also a kind of counterparty risk in it, which is ‘who are the institutions that you’re working with?’ Have you got confidence and reliability on the financial institutions that you’re using to process those payments? If you’re using a small local bank in just one market, in just one currency, how reliable or secure are they as a provider versus someone who does this on a much more global, broader-reach basis for you?

And the final flag to raise is one of reputational risk. If you’re consistently poor at cash management and it ends up costing you money to pay people accurately or you end up paying suppliers late, that can impact your credibility and often trading terms.

Q. And let’s talk about the process once it is all set up (the traditional way). So, you’re a global enterprise company, you’ve multiple bank accounts across the world in multiple currencies. Where do the problems lie when it comes to managing those currencies and those bank accounts?

That’s where you return to that original principle – can I get the right amount of money in the right place, at the right time, and in the right currency? When you operate the traditional way with multiple local bank accounts in multiple currencies, the risk comes to the fore when you go to use it in the real world.

Let’s take a manufacturing business as an example.

With manufacturing, you’ll generally have your raw materials come from a certain number of places, and you’ll have to pay for them in a certain subset of currencies, but you probably sell them in other parts of the world and get paid in other currencies.

You are going to be consuming cash in one place and in one currency, and potentially selling it to another place in a totally different currency, and therefore, you’ve got to join all that up in terms of getting funds in the right place at the right time in those right currencies. How do I convert my receivables in one currency to help fund payables I’ve got and expenses in another currency?

And, if you can’t join it up efficiently, you’ll often have to go the route of borrowing money to make up shortfalls. Which, of course, costs you more.

And this is where we get to the central crux of efficient international cash management; you don’t want to have surplus funds sitting in one part of the world in one currency and then be consuming and borrowing money in a different place or through a different account in a different currency.

You’re not using your surplus efficiently, and in practical terms, you’re also creating a deficit that you theoretically don’t need as an organization.

Q. And when we talk about visibility, is it a complex endeavor just to figure out what cash is available and where?

It can be. I’ve been at conferences in the past where you talk to group treasurers of large multinational corporates, and they say they have got hundreds, sometimes even thousands, of bank accounts globally. So, just getting visibility of what is where can be really, really tricky, particularly in decentralized organizations.

You may have delegated a local team in Hong Kong who run all things APAC for you, and they may have opened bank accounts with local banks in Hong Kong or Singapore and not even told you if you what they’re doing. So, just getting that visibility of what you’ve got and what’s it’s being used for can be quite, quite challenging, and hence why goes back to a first principle of good international cash management is to get visibility of all of your cash.

Q. So, what’s the difference between the sort of traditional corresponding banking approach we’ve been talking about up until now and the fintech sector approach to help facilitate international cash management? Where do they differ, in particular?

The big benefits of the fintech approach vs the traditional one is speed, cost and control. We remove many of the hurdles businesses need to get over when establishing a banking presence in the market, and reduce the costs both in setting-up an international banking infrastructure, and running it.

The big benefits of the fintech approach vs the traditional one is speed, cost and control.

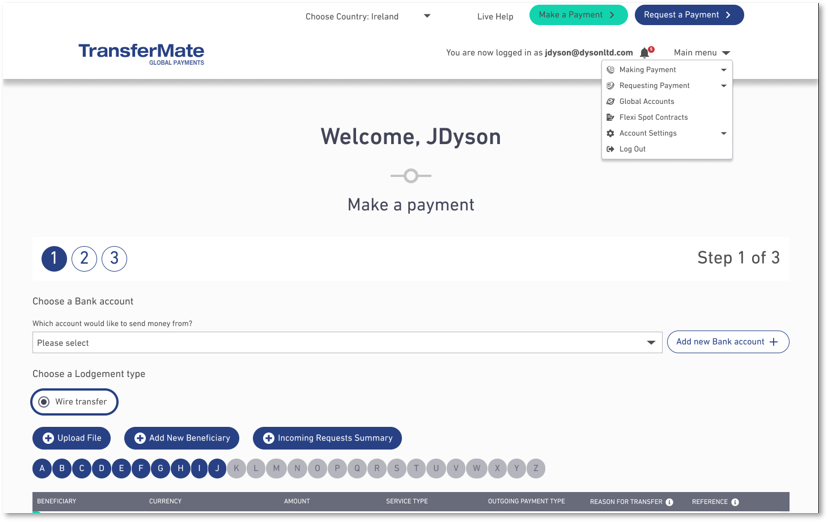

The next step – and one we’ve made already – is about making the strategic management of international cash easier and more efficient for financial leaders. We do this through leveraging the infrastructure we’ve built up to provide speed and cost savings on the actual processes, and then combining it with easy-to-use platforms to provide visibility and agility.

This visibility and agility equals control for businesses over their international cash management.

Q. So what does TransferMate bring to the market? What’s your solution and what does it do?

Through our Global Accounts solution, we can allow a customer to open an operational global account in any one or all of 27 currencies in about 30 seconds. So, if you contrast that to days, weeks, months to open a traditional bank account, it’s night and day. Even if you add a few days on for onboarding with us as an institution, it’s rapid.

The platform itself is easy-to-use and gives central visibility on the global accounts. We’ve been very focused in our roadmap on the balance and transaction reporting that goes alongside the accounts because we’re conscious that, as part of that visibility of cash, our customers are going to need to digest that data and information. We provide that both through the website and through our API suite.

We’ve spent time on making sure that we give as much visibility and richness of balance and transaction information as possible, and we really focus on the integration API side and allowing customers to digest that into whatever ERP or other in-house platforms they’re using. So basically, it’s all about trying to maximize being compatible with the systems and processes that our clients use.

Together with the extensive access to local payment rails our Global Accounts and payments network offers, the efficiency and transparency of what we do from an international payments’ perspective supports businesses speeding up and managing their international cash. So, we can help you get your funds to the place at the right time in the right currency faster and more efficiently and at lower FX cost compared to the traditional banking network.

Jonathan, thanks very much.

For more on how TransferMate can support you in creating and managing global bank accounts in multiple currencies, read more about our Global Accounts solution.

Use bulk payments to make up to 5,000 payments to employees or partners with a single click